This subresource enables user to find pending fund transfers for the investor's account.

Operation: GET

URL: https://api.lendingclub.com/api/investor/[version]/accounts/[Investor Id]/funds/pending

URL Parameters: Investor Id — This can be obtained from the Account Summary section on LendingClub website when a user is logged in.

Query Parameters: None.

Supported Formats: JSON, XML, CSV

Request/ Response data:

Name | Type | Nullable | Description |

|---|---|---|---|

transferId | integer | No | Transfer transaction Id |

transferDate | Date | No | Transfer Scheduled Date |

amount | BigDecimal | No | Transfer amount |

sourceAccount | String | No | Transfer Source Account |

status | String | No | Status of the Scheduled Transfer |

frequency | String | No | Frequency of Fund Transfer. |

endDate | Date | Yes | Recurring transfer end date or null is returned in case of one time transfers |

operation | String | No | Type of transfer. Valid Values: |

cancellable | Boolean | No | Returns boolean indicating whether this transaction can be cancelled or not. |

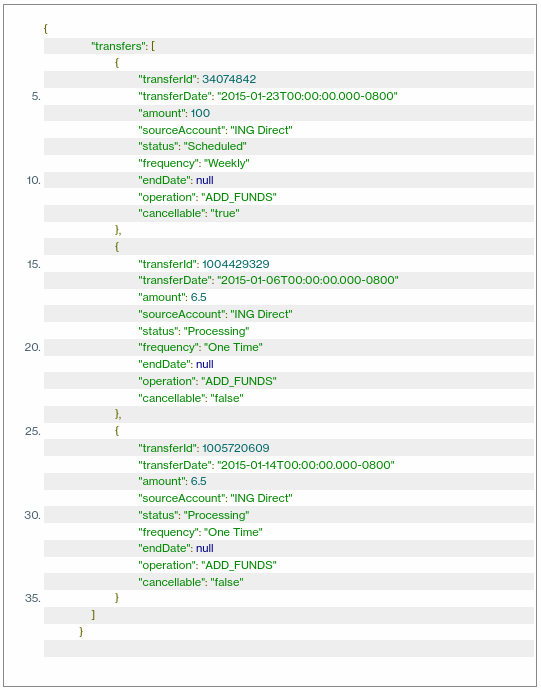

Response: JSON -

Response: XML -

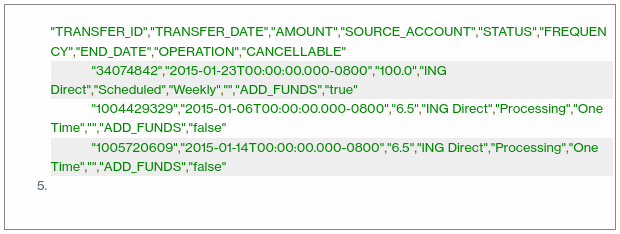

Response: CSV -