This subresource provides a detailed list of notes that are owned by the investor. In addition to the data provided by Owned Notes resource, this one adds financial information regarding the notes.

Operation: GET

URL: https://api.lendingclub.com/api/investor/[version]/accounts/[Investor Id]/detailednotes

URL Parameters: Investor Id — This can be obtained from the Account Summary section on Lending Club website when a user is logged in.

Query Parameters: None.

Supported Formats: JSON, XML, CSV

Name | Type | Nullable | Description |

|---|---|---|---|

loanStatus | String | No | Loan status |

loanId | integer | No | Loan Id |

portfolioName | String | Yes | Portfolio name |

noteId | integer | No | Note Id |

grade | String | No | Subgrade |

loanAmount | BigDecimal | No | Loan amount |

accruedInterest | BigDecimal | No | Accrued Interest |

noteAmount | BigDecimal | No | Note amount |

purpose | String | No | Purpose |

interestRate | Number | No | Interest rate |

portfolioId | integer | Yes | Portfolio Id |

orderId | integer | No | Order Id |

loanLength | integer | No | Loan length |

issueDate | String | Yes | Issue date |

orderDate | String | No | Order date |

loanStatusDate | String | No | Loan status date |

creditTrend | String | No | Credit trend |

currentPaymentStatus | String | Yes | Current payment status |

canBeTraded | boolean | No | Can be traded |

paymentsReceived | BigDecimal | No | Payments received |

nextPaymentDate | String | Yes | Next payment date |

principalPending | BigDecimal | No | Principal pending |

interestPending | BigDecimal | No | Interest pending |

interestReceived | BigDecimal | No | Interest received |

principalReceived | BigDecimal | No | Principal received |

applicationType | String | Yes | The loan application type. Valid values are "INDIVIDUAL" or "JOINT" |

disbursementMethod | String | No | The loan disbursement method. Valid values are "DIRECT_PAY" or "CASH". |

Returned value: JSON -

Returned value: XML -

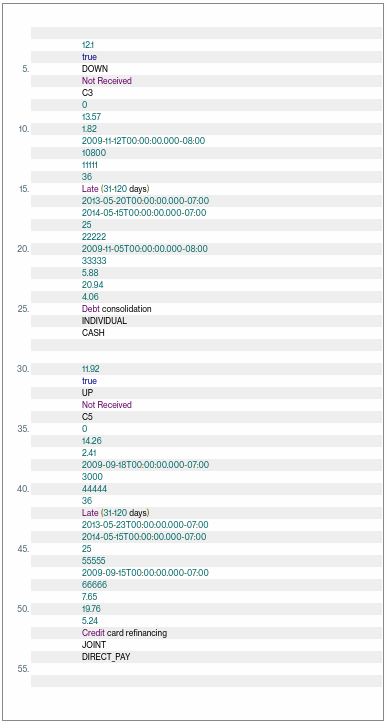

Returned value: CSV -