Taking out a loan can be a big decision, and the Truth in Lending disclosure is a standard form designed to help you understand your loan's specific terms, like how much you've borrowed, how many payments you'll make, and what your annual percentage rate (APR) is.

Make sure to read over this form before signing and agreeing to your loan terms. If you've already signed your loan documents and want to review your Truth in Lending disclosure, you can sign in to your Member Center and go to the Loan Documents section.

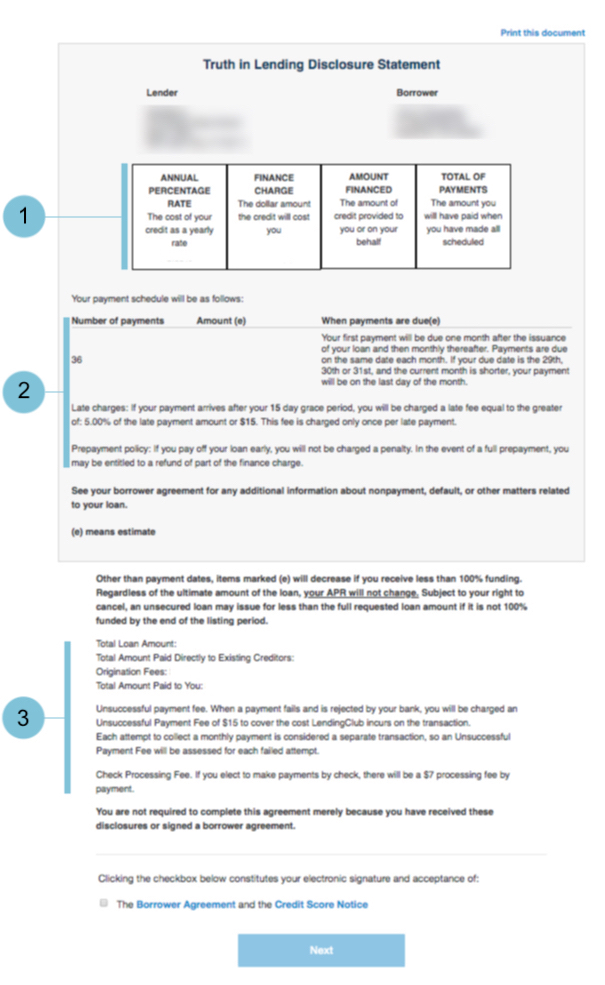

This section shows an overview of your loan, laying out your APR, total loan amount, and the amount you'll pay over the life of your loan.

Annual Percentage Rate (APR):This reflects your yearly interest rate and origination fee.

Finance Charge:This charge shows the total amount you'll pay in interest, plus your origination fee. Think of it as your APR as a dollar amount. This is an estimate, because if you make extra payments or pay off your loan early, you'll pay less in interest.

Amount Financed:The amount financed is the amount you borrowed minus your origination fee, which matches the amount under "Total Amount Paid to You."

Total of Payments:This is the total amount you'll pay by the end of your loan if you make on-time monthly payments and make no extra payments. This is an estimate, because if you make extra payments or pay off your loan early, you'll pay less in interest. If you pay late, you'll pay more with possible late fees or additional interest.

Your payment schedule shows the total number of payments you'll make, the amount of each payment, your due date, and the date you'll pay off your loan.

This breakdown shows you your total loan amount, the origination fee, and the total paid to you.

Total Loan Amount:The amount of your loan, including the origination fee.

Origination Fee:This one-time fee of 2–6% is only charged when you get your loan, and it's reflected in your APR.

Total Amount Paid to You:The amount you received in your bank account.