You can go online anytime to add or change what bank accounts are linked to your LendingClub account. You can set up a bank account for autopay or to make easy one-time payments. After you add a new bank account, we’ll send an email asking you to confirm it.

Automatically link your new bank account

Linking your bank account to your LendingClub account is simple. When you automatically link an account, you're the only one who sees your bank login information—we never have access to it.

Sign into your Member Center and click Settings.

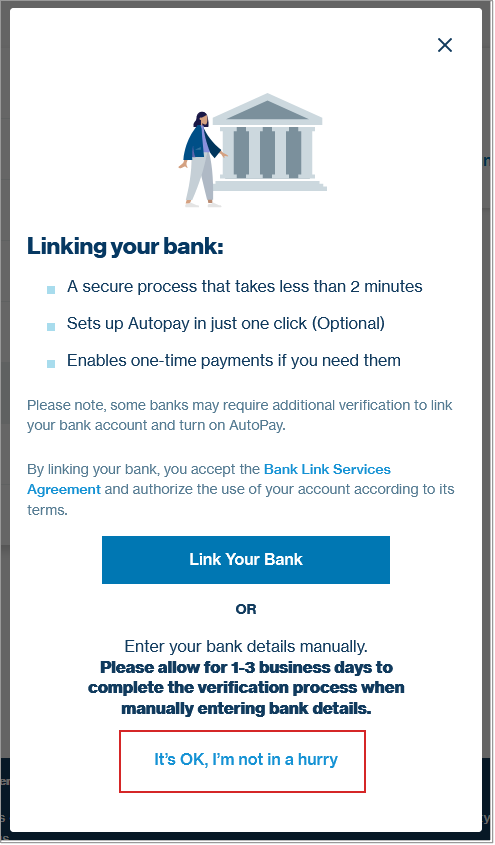

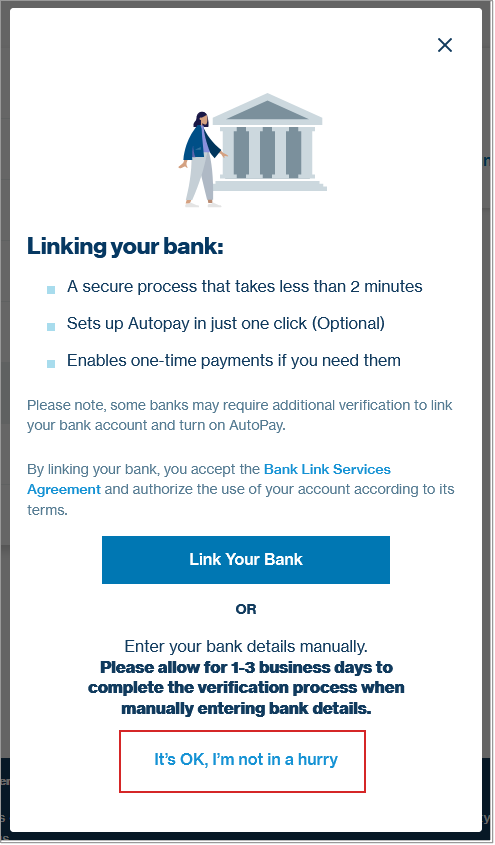

Click Payment Methods, then click Add New Account.

Click Link Your Bank.

Choose your bank from the list. (Note: If your account doesn’t appear on the list, you can manually link your account. See the next section for details.)

Enter the username and password you use to sign into your bank account online, then click Submit. (Note: Some banks may confirm your identity through a security question or a code they’ll email or text you.)

Choose the bank account (for example, checking or savings) you want to link.

Enter your name as it appears on your bank account.

Select the box to authorize your account for automatic payments.

Click Submit.

After you finish these steps, look for an email with instructions to confirm your bank account. It can take a few minutes for the email to arrive in your inbox.

Manually link your bank account

To manually link your bank account to your LendingClub account:

Sign into your Member Center and click Settings.

Click Payment Methods, then click Add New Account.

Click It’s OK, I’m not in a hurry.

Enter your name as it appears on your bank account.

Choose whether the account you want to link is a checking or savings account.

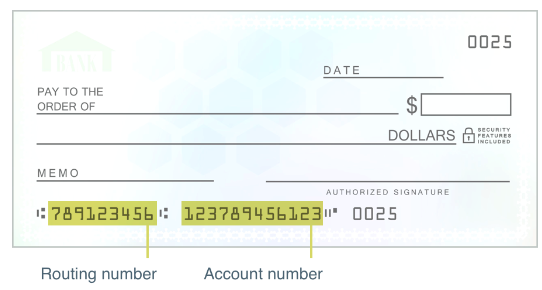

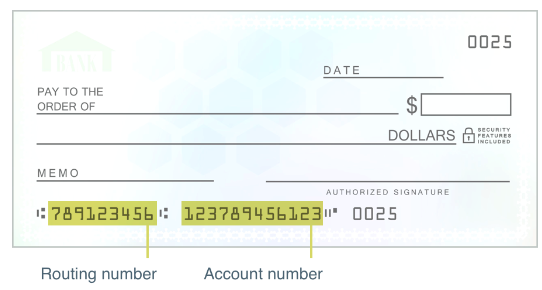

Enter your bank name, routing number, and bank account number.

For checking accounts, these are at the bottom of your checks:

Once you link your new bank account, we’ll send a test deposit and debit within four business days. The test transactions will be for an amount of less than $1.

Note: Credit unions sometimes use a different account number for automatic transactions. If the account you’re connecting is with a credit union, confirm with them that it’s the account number for ACH deposits and withdrawals.

Under Setup Autopay, select the box if you’d like to use this account to set up autopay on any accounts you have with LendingClub.

Select the box that authorizes LendingClub to link to your bank account.

Click Verify Account.

Change the account you use for autopay

To change your autopay account:

Sign into your Member Center and click Settings.

Click Payment Methods, then for the account listed as Autopay is on, click Change.

In Update your autopay settings, select the account you’d like to switch to for autopay.

Click Update.