{noun} All monthly debt payments divided by monthly gross income, expressed as a percentage.

Debt-to-Income (DTI) Ratio

What is Debt-to-Income (DTI) Ratio?

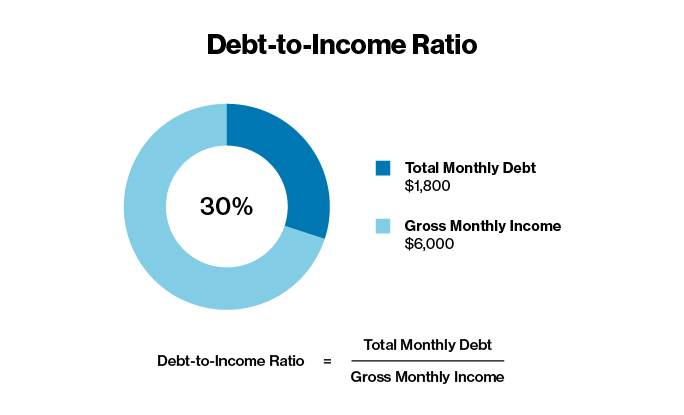

Your debt-to-income ratio is all your monthly debt payments divided by your gross monthly income, expressed as a percentage. In other words, it’s what you earn every month minus what you owe every month. This ratio is one way that lenders measure your ability to manage monthly payments and repay money you plan to borrow.

How Is Debt-to-Income Calculated?

Simply add up all your monthly debt payment obligations (such as housing, loans, and minimum credit card payments) and divide them by your monthly income before any deductions are taken out (i.e. your gross income). The resulting percentage is your DTI.

Why Is Debt-to-Income Important?

If you’re applying for new credit, such as a loan or credit card, lenders will ask for your monthly debt obligations and monthly income so they can calculate your DTI. This helps them decide whether you’re in a position to handle more monthly debt payments. A low debt-to-income ratio makes you a better, less risky candidate and theoretically improves your odds of being approved. (Other factors, such as your credit score, also matter.)

What’s Included in Debt-to-Income?

To calculate your monthly debt, lenders look at mortgage or rent payments, credit card payments, student loan, auto, and other loan payments, as well as monthly child support or alimony payments. Not included are expenses such as utilities, cable and phone bills, health insurance, food, etc.

Gross monthly income is the average amount of money you make every month before taxes and other deductions are taken out. This can include wages, bonuses, overtime, dividends and freelance income, alimony, etc.

What Are the Two Types of Debt-to-Income?

Lenders typically divide the debt portion of your DTI ratio into two types: front-end and back-end.

The front-end DTI ratio reflects how much of your gross monthly income is going toward housing. Lenders generally like to see a front-end DTI of 28% or lower.

Back-end DTI reflects how much of your gross income is going toward other types of debt like car loans, personal loans, credit cards, and the like. Lenders prefer borrowers with a back-end DTI of 36% or below.

Most lenders primarily look at back-end DTI because it presents the most accurate account of your recurring monthly costs. But mortgage lenders typically use both. Different lenders and loan products will have different DTI limits.

How Does Your Debt-to-Income Ratio Affect Your Ability to Qualify for a Mortgage?

Simply put, the higher your debt-to-income ratio, the greater the risk you will not be approved for a home loan. According to a study conducted by NerdWallet, a high debt-to-income ratio was the most common reason for mortgage denials in 2020. The vast majority of those who were denied had a DTI of 50% or above. It’s worth noting that different types of home loans (e.g. conventional vs. USDA, etc.) may have different DTI maximums.

Your debt-to-income ratio might also serve as an indicator to you as to how much of a monthly house payment you can comfortably afford.

What Is a Good Debt-to-Income Ratio?

Standards differ from lender to lender, but a lower DTI is better. Most lenders like to see a debt-to-income ratio at or below 36%. Keeping your DTI at or below this figure can improve your chances of getting approved for a loan with more favorable terms. For example, if your gross monthly income is $3,000, you’d want your debt payments to be at or below $1,080 per month. While standards and guidelines vary, some mortgage lenders allow a debt-to-income ratio of up to 43-45%, and some FHA-insured loans allow up to 50%.

If your DTI is high, a lender may compensate for the higher risk by charging you a higher interest rate. If your loan payments consume half or more of your monthly income, that may be a sign you have more debt than you can handle and lenders may deny your application.

What Are the Best Ways to Improve Your Debt-to-Income Ratio?

A lower debt-to-income ratio can help you borrow more money from lenders and secure better credit terms. Since your DTI ratio is essentially what you owe every month divided by what you earn every month, the best way to improve it is to owe less or make more. This often takes careful planning, discipline, and patience.

Create a monthly budge with a line item for paying down your debt and stick to it. You might also consider postponing large purchases and consider taking on a side gig to increase your monthly income.