Once you submit your application, we'll try to confirm your information on our own. Sometimes, you may need to submit a few things to confirm your identity, income, and employment. Keep an eye on your email or check your To-Do List anytime to see what’s left to wrap up your application.

You can submit documents by uploading them from your computer or your mobile device. We can't accept links to documents from online storage services, like Google Drive or Box.

Income documents

The exact documents you may need depend on your situation. For example, someone who's self-employed will likely need to provide different documents than someone who is employed by a company.

Common documents that show income:

Pay stubs

Recent bank statements

1099 forms

If your income comes from different sources, you can provide:

Retirement

Alimony

Child support

Other types of income documents, if you'd like them considered

If you're self-employed or a freelancer, you may need to submit a recent tax return or other forms like a W-2 or 1099.

The IRS Form 4506-T lets us ask the IRS for copies of your tax returns, W-2, and 1099 forms. It helps us quickly confirm your income. If you see this on your To-Do List, you can download the Form 4506-T there, or you can get it from the IRS (see Completing the Form 4506-T for instructions on filling it out).

Identity and address documents

You may need to provide a copy of your government-issued photo ID, recent utility bills, or other documents. These help confirm your identity and current address.

You can provide these other documents instead, as long as they show your name and current address:

Cable, water, waste management, phone, or local gas or electricity bill

Vehicle registration (must show a physical address)

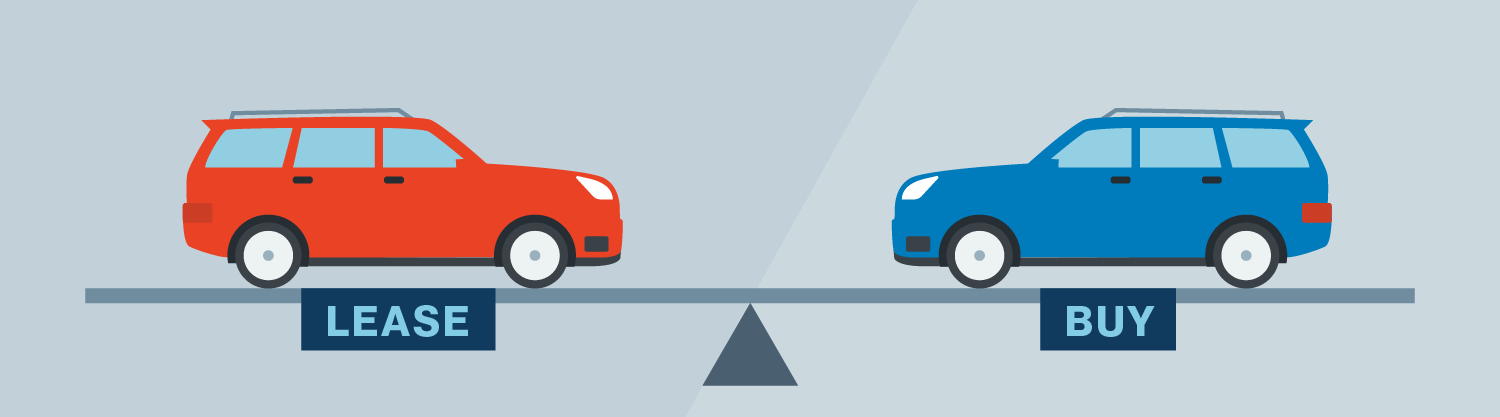

Lease agreement

Bank or mortgage statements

Government-issued photo ID (Note: For your security, please do not send a copy of a military ID)

Pay stubs

Official change of address confirmation from USPS

Automobile, homeowner's, or renter's insurance

You can upload your documents through the online portal (the quickest option), or fax them with the cover sheet in your Member Center to the number listed on that cover sheet.

Here are some of the things we might request. Each request in your To-Do List shows the requested information:

Business Tax returns: We use these to verify your income and sales. We may ask for copies of your recent tax returns or for tax forms, such as 1099s or Schedule K1s, to verify all of the details.

IRS Form 4506-T: We use this form to request copies of your tax returns, W-2s, and 1099 forms directly from the IRS. A completed form can quickly help us verify your income. Your Client Advisor will work with you to complete the form and ensure the signatures are valid.

Proof of personal income: We may ask for additional documents to verify your personal income, such as recent bank statements or pay stubs. In some cases, we may need proof of income for alimony or child support, pension or annuity income, or disability insurance or Workers’ Compensation benefits, or other types of income.

Proof of identity and address for you or your business: We may request a copy of your government-issued photo ID, recent utility bills, or other documents to verify your business and personal identity and current address.

Document verifications

Once you’ve uploaded all the documents we’ve requested, you’ll see a status update that your documents are in review. If we need additional information while your application is in review, we'll reach out to you by phone or email.

It usually takes about two business days for us to review your documents.