You can view and change most of your account information right from your Member Center, including your password, phone number, physical address, and email address. You can also view, but not change, your account ID. Changing the name on your account requires a few extra steps.

Find your account ID

Your account ID is a unique identifier for your account. When you call or email for help with your account, having your account ID handy helps our team locate your account information faster. You can find your account ID at the top of the page when you sign into your Member Center.

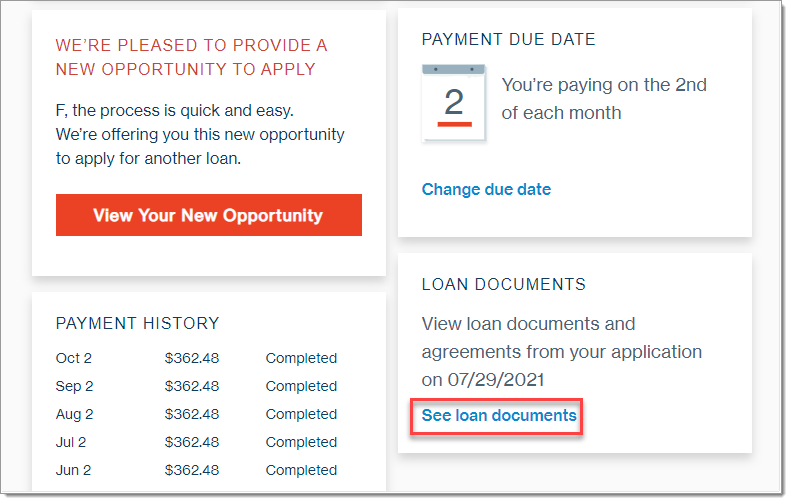

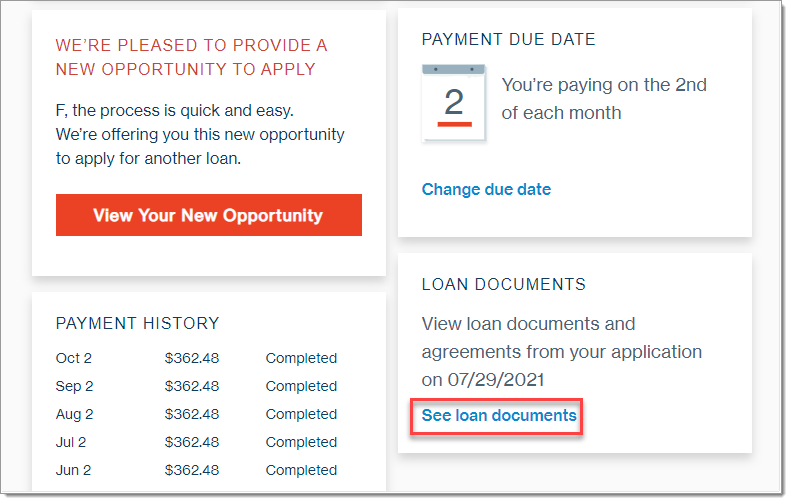

View Your Loan Documents

Sign into your Member Center and click View Loan.

Under Loan Documents, click See loan documents.

Change your password

To change your password:

Sign into your Member Center and click Settings.

Click change password.

Enter your old password.

Enter and confirm your new password. To create a strong password, use special characters, like $ or %, as well as both upper- and lowercase letters.

Click Submit to reset your password.

You can now sign in with your new password.

Reset a forgotten password

If you've forgotten your password:

Click Forgot Password on the sign-in page.

Enter the email address you used to open your account, then click Submit. We'll send you an email with a password reset link. If you no longer have access to that email address, contact us for help.

In the email, click Reset Password. If you can't finish resetting your password the first time, you can click Forgot Password on the sign-in page again, and we'll send you a new email with a unique link.

On the Reset Password page, enter the requested information. We ask for additional information to keep your account secure.

Enter and confirm your new password. To create a strong password, use special characters, like $ or %, as well as both upper- and lowercase letters.

Click Submit. You'll receive an email confirming that your password has been updated.

You can now sign in with your new password.

If you're still having trouble signing in, your account may not be active. For example, your account may be deactivated after several months if you check your rate but don't accept any offers. If this is the case for you, you'll need to open a new account.

Secure your account with two-step authentication

Two-step authentication helps prevent other people from accessing your account by adding an extra layer of security. After you turn on two-step authentication, you'll need to enter a time-sensitive code sent to your email every time you sign into your Member Center.

How to set up two-step authentication

To set up two-step authentication:

Sign into your Member Center.

Click Settings.

Click Change opt-in next to "Two-Step Authentication."

Toggle the switch to turn on two-step authentication for your account.

Using two-step authentication

Once two-step authentication is active, you'll need a verification code plus your login information each time you sign into your Member Center.

Sign in to your Member Center.

Check your email or text for a message from us.

Enter the verification code from the email or text in the Security Code field and click Sign in.

This code is good for 10 minutes. If you can't use the verification code within that time frame, click Resend it now to get a new code. When you request a new code, the previous codes expire. Only the most recent code will work.

Change your email address

To update your email address:

Sign into your Member Center, then click Settings in the upper-right corner.

Click Email.

Enter your new email address. The email address can't be one already used for a different LendingClub account.

For your security, you'll need to enter your password and complete the CAPTCHA to confirm that a real person is making the change.

Click Save changes.

Change your address or phone number

To update your address or phone number:

Sign into your Member Center and click Settings in the upper-right corner.

Click Address or Phone Number.

Enter your new contact information.

For your security, you'll need to enter your password and complete the CAPTCHA to confirm that a real person is making the change.

Click Save changes.

Change your name

If your legal name has changed or your name is misspelled on your account, follow the instructions below.

Change your legal name

To change the legal name on your LendingClub account, you'll need to send us a copy of a legal document that confirms your name change. Once we've verified that, we'll update your name for you. Here's what you can submit:

Legal name change document

Court-issued decree

Legal court order

Adoption certificate

Government-issued ID from before and after the name change

For your security, do not send a copy of your military ID.

Correct a misspelling

If there's a typo in your name, contact us by following the instructions above and attach a current, government-issued photo ID. We'll be happy to review what you submit and update the spelling if needed. For your security, do not send a copy of your military ID.

Close your account

Once you pay off your obligation, your account is no longer active. The payoff will be reported to the credit bureaus within 30 days of the final payment. If you need an official payoff statement, let us know. We're happy to help!

For instructions on paying off your outstanding balance, see paying off your loan. For information on canceling, see canceling your application.

If you applied for a lending product and didn't accept or receive an offer, your account may not be active.