Balance Transfer Loans

Consolidate your debt

What is a balance transfer loan?

A balance transfer loan is a personal loan that simplifies debt consolidation by letting LendingClub Bank pay some or all of your creditors for you. You choose which accounts are paid and how much of your new loan amount you want applied to each. Any funds remaining from your loan amount after your creditors are paid will be deposited directly into your bank account.

Join over 5 million members nationwide

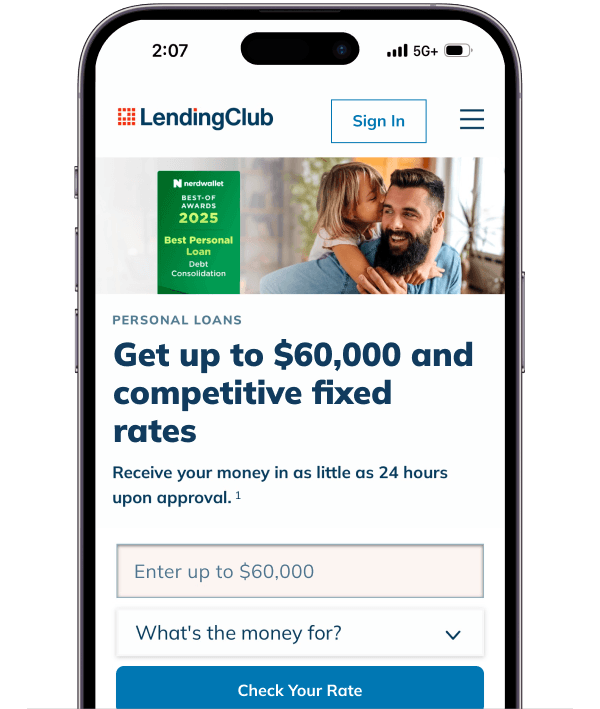

Borrow up to $60,000

Quick and easy online application

Eligibility based on credit history

Funding in as little as 24 hours

No prepayment fees

Access some of our lowest available rates

Save money

Save time

Improve your credit

When you transfer debt from one credit card to another, you may not be setting yourself up for financial success. Oftentimes, many people end up transferring what they already owe from one high-interest credit card to what eventually turns out to be another high-interest rate card—and, unfortunately in many cases, wind up paying a transfer fee and accumulating even more debt due to introductory offers.

Many credit card companies offer a 0% introductory rate for 6 months or one year or more which can be enticing. Unfortunately, unless that time is used to only concentrate to pay off the debt transferred, the temptation to rack up new debt can be hard to resist and you may find yourself starting the same cycle all over again in a couple of years.

In contrast, a balance transfer loan from LendingClub Bank is a better way to take control of your debt in two ways:

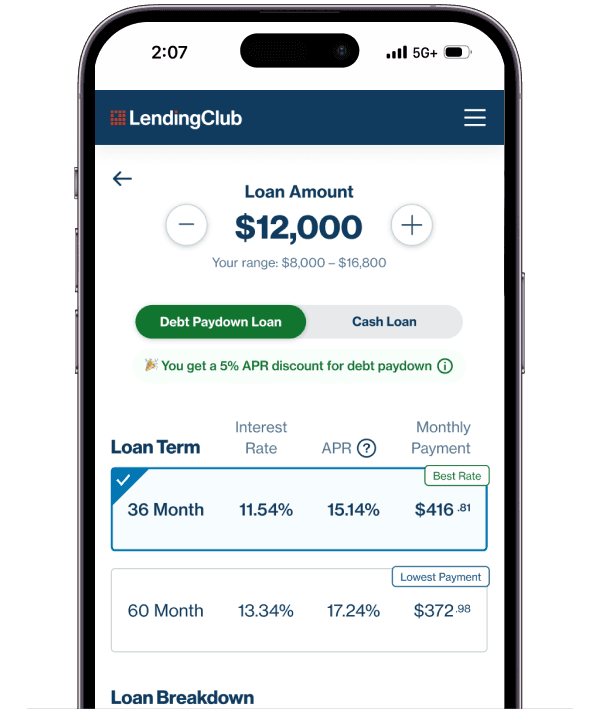

Transferring your credit card balance into a competitive, fixed-rate personal loan repaid over a set period

Allowing us to pay your creditors for you—saving you time and hassle

And unlike revolving credit card debt, your APR and monthly payment will never change. This means from the moment you take out your loan, you will be on a clear path toward creating a more stable financial future.

We work with a partner network of over 1,700 credit card, bank, and lending companies. As you complete your balance transfer application, you can add your creditors to see if they are accepted. You can add up to 12 creditors or accounts per loan.

With a balance transfer personal loan, some or all of your loan is used by LendingClub Bank to pay your creditors directly, making it simple for you to quickly and easily consolidate credit card and high-interest debt with the least amount of effort. Once your creditors are paid by LendingClub Bank, any remaining funds will be deposited directly into your bank account.

With a cash loan, all loan proceeds are directly deposited into your bank account at funding, which means it’s up to you to write the checks or initiate bank transfers to consolidate or pay down your debt. While a cash loan can offer additional flexibility in terms of how and when you use your loan proceeds, it also means you will be solely responsible for paying your creditors. With a balance transfer loan, we make it easy by handling that part for you.

Applying is easy and the entire process can be completed online using your phone, laptop, or tablet. You can help keep things moving along by checking your To-Do List and making sure you have submitted all the documents and information requested.

Checking your rate with LendingClub has absolutely no impact on your credit score because we use a soft credit pull. A hard credit pull that could impact your score occurs only if you continue with your application and a loan is issued to you.

Also remember that a personal loan could have a positive impact on your credit in the future if you’re able to show a history of on-time payments and a reduction in overall debt (not taking on new debt, such as higher credit card balances).

With a personal loan from LendingClub Bank, you can choose to have payments automatically withdrawn from your bank account each month. We'll email you a reminder a few days in advance so you can make sure you have the money.

If you prefer mailing us a check each month instead, that’s okay, too. You can also change your payment date, make additional payments, or pay off your loan right from your Account Summary.