members-only levelup checking

Earn 2% cash back for LendingClub personal loan payments

Set up Direct Deposit to earn cash back with our brand-new, $0-fee LevelUp Checking account.1

LevelUp Checking is for members only. You must have or have

had a LendingClub product to open an account.

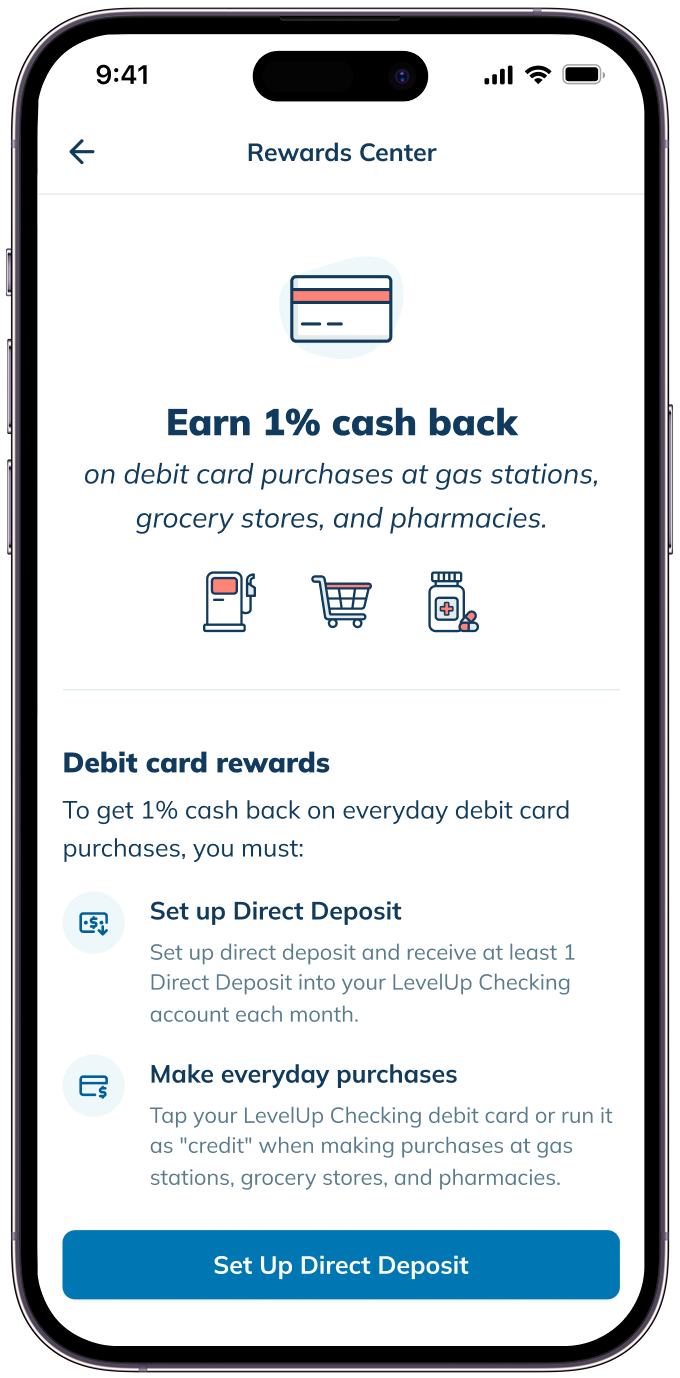

Earn 1% cash back on Qualified Purchases when you use your debit card at gas stations, grocery stores, and pharmacies.3

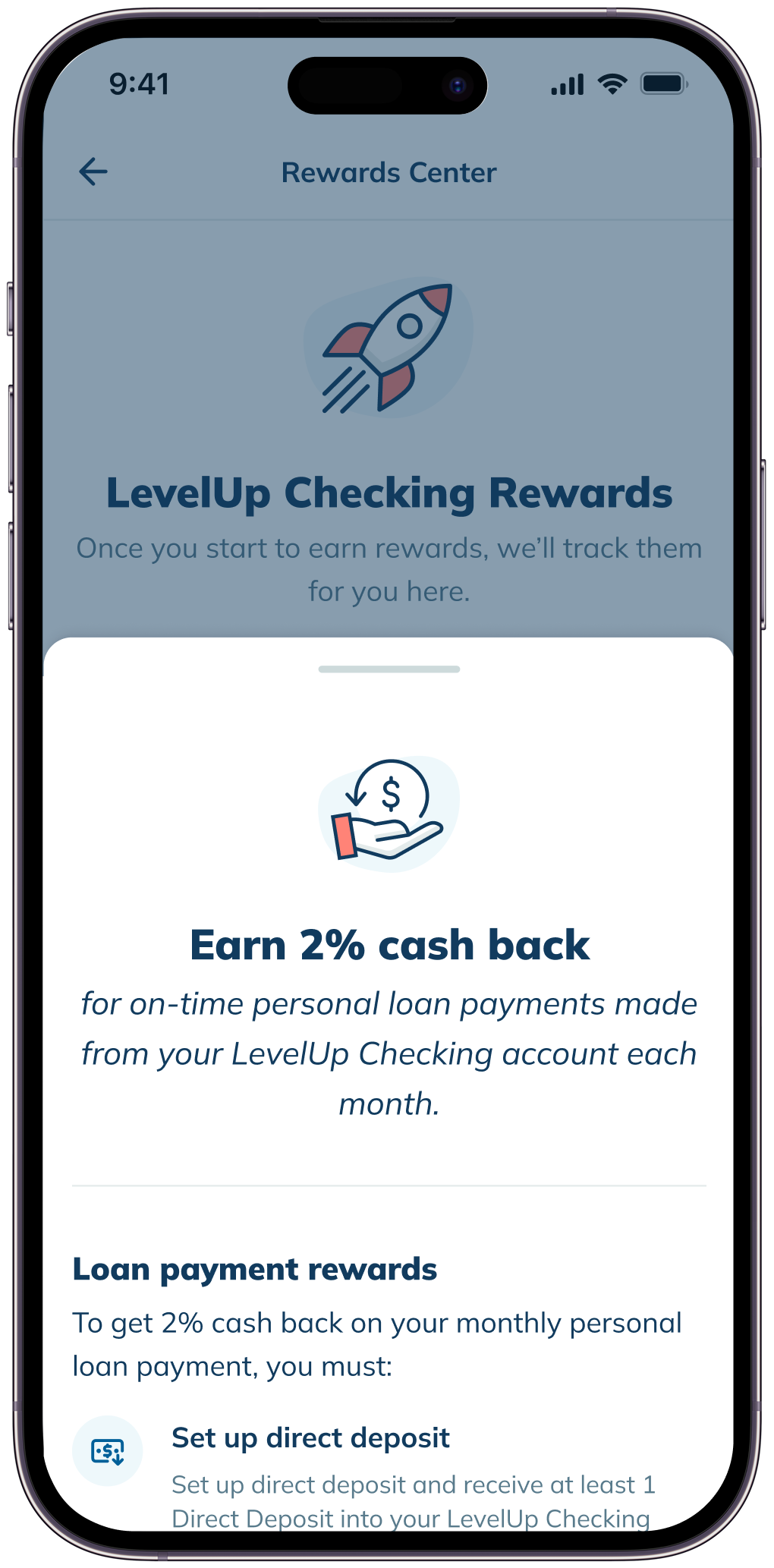

Already have a LendingClub personal loan? You'll earn 2% cash back for on-time payments from your LevelUp Checking account.1

You could get your paycheck up to 2 days early, giving you faster access to the money you need.4

Unlock all these benefits with a Direct Deposit into your account each month.

Want even more perks? You got it!

1.00% APY

$0 fees

Unlimited ATM fee rebates

Stack your products. Stack your benefits.

Earn money back on personal loan payments

To earn 2% cash back, set up Direct Deposit and make an on-time payment from LevelUp Checking to your LendingClub personal loan.

Boost your earnings with LevelUp Savings

Earn 4.40% APY with LevelUp Savings when you deposit $250+ per month. ⁷

Track your rewards in the LendingClub app

Check how many rewards you’ve earned so far in your personalized member rewards center.

Earn 2% cash back on personal loan payments in 3 easy steps

Open an account

Set up Direct Deposit

Pay your personal loan on-time

Open a member-exclusive

LevelUp Checking account today

$0 fees. $0 minimum balance. Unlimited cash back.3

Your membership gets

better in the app

Make the smartest money move of the day.

Download the LendingClub app now.⁸

To get 2% cash back on your monthly LendingClub personal loan payment, follow these requirements:

Set up Direct Deposit: Set up Direct Deposit and receive at least 1 Direct Deposit into your LevelUp Checking account each month.

Pay your LendingClub personal loan on time: Pay the monthly payment amount on your LendingClub personal loan on time and from your LevelUp Checking account.

See Terms & Conditions for additional details.

To get 1% cash back on Qualified Purchases, follow these requirements:

Set up Direct Deposit: Set up Direct Deposit and receive at least 1 Direct Deposit into your LevelUp Checking account each month.

Make Qualified Purchases: Simply tap your LevelUp Checking debit card for an automatic credit purchase or choose “credit” when swiping or inserting your card in-store at qualifying gas stations, grocery stores, and pharmacies.

There are no fees for your account.

LendingClub doesn't charge a fee to use another bank’s ATM. LendingClub is centered around empowering you to meet your financial goals and will reimburse you for ATM fees charged by other banks and ATM owners. Your reimbursements will appear in your LevelUp Checking accounts, when they’re posted to your account at the end of each statement cycle.

Any earned rewards for your account will be posted the following month in the Rewards Center within the LendingClub app and online banking.

Security

FDIC Insurance

Customer support

Chat with us online, or reach us by phone or email.